Introduction

Are you constantly struggling to save money, even when you try to cut back on spending? Do you feel like your paycheck disappears without a trace? If so, you’re not alone. In a world dominated by digital transactions and impulsive purchases, staying in control of your personal finances can feel like a daunting challenge. But there’s a surprisingly simple, time-tested method that might be exactly what you need: the Kakeibo method.

This Japanese technique goes beyond numbers and spreadsheets. It focuses on mindful spending, reflection, and financial awareness — empowering you to take control of your money while improving your emotional well-being. In this article, you’ll learn what the Kakeibo method is, how it works, and how to apply it to your daily life to save more money with purpose and clarity.

What Is the Kakeibo Method?

Kakeibo (pronounced kah-keh-bo) translates to “household financial ledger” in Japanese. Developed in 1904 by Hani Motoko, Japan’s first female journalist, Kakeibo is more than a budgeting tool — it’s a philosophy of conscious spending and saving. The method encourages you to write down your income and expenses manually, reflect on your financial decisions, and ask yourself key questions before making purchases.

Unlike traditional budgeting apps or automated tools, Kakeibo emphasizes the emotional side of money. It promotes mindfulness in financial decision-making, helping you identify your spending patterns, understand your needs versus wants, and align your money habits with your personal values and goals.

Why the Kakeibo Method Works

The success of Kakeibo lies in its simplicity and psychological impact. Writing things down creates awareness, and reflecting on your choices fosters accountability. Over time, these habits naturally lead to better financial decisions and consistent savings.

Key principles of Kakeibo:

- Be intentional about every purchase.

- Regularly review and analyze your expenses.

- Reflect on your emotions and triggers when spending.

- Prioritize savings as a lifestyle, not an afterthought.

How to Apply the Kakeibo Method: Step by Step

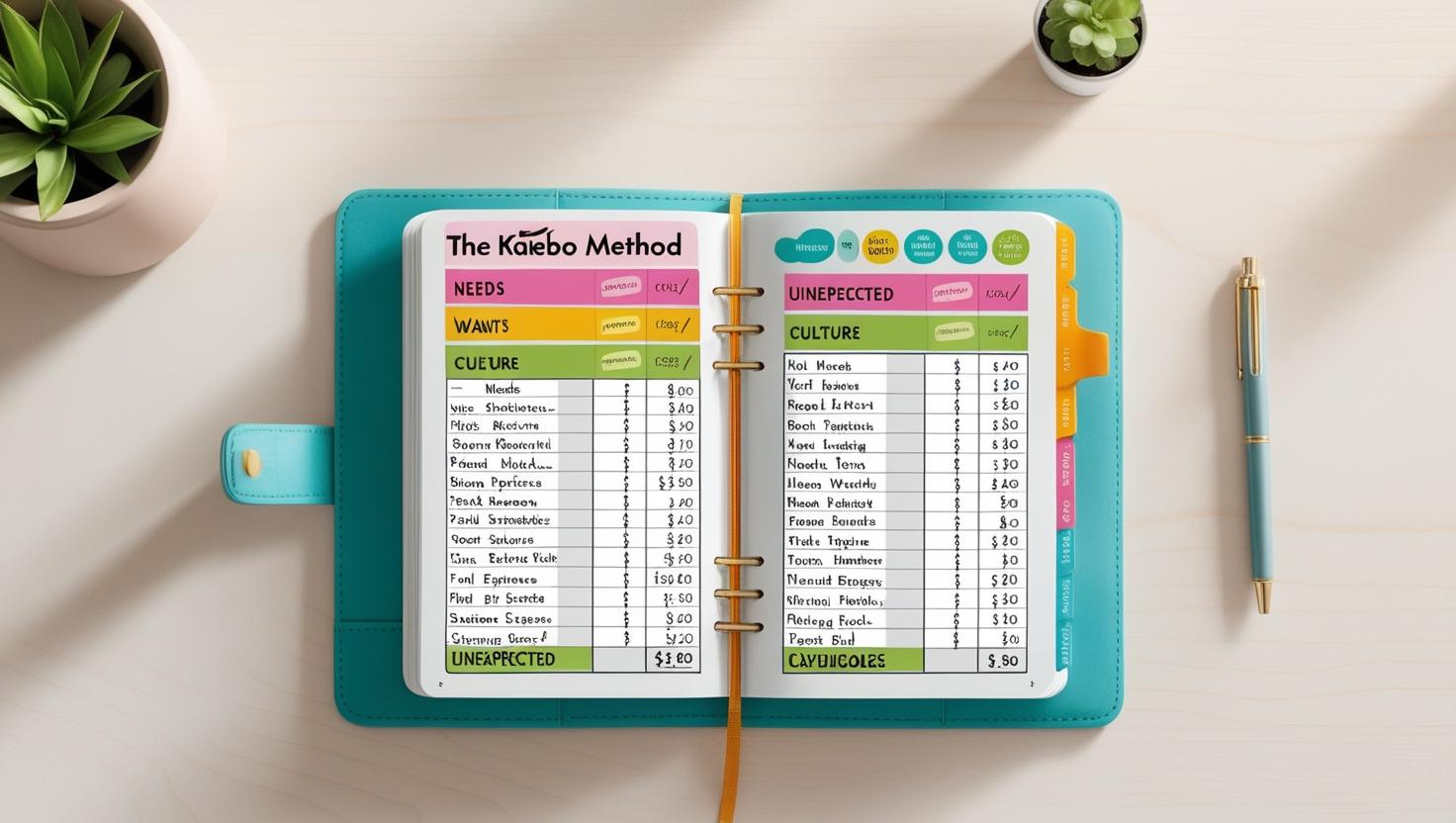

Step 1: Set Up Your Kakeibo Journal

Start with a simple notebook or dedicated journal. You don’t need anything fancy — what matters is consistency. Divide your journal into the following sections:

- Monthly income: List all your sources of income.

- Fixed expenses: Rent, bills, subscriptions, transportation, etc.

- Savings goal: How much would you like to save this month?

- Budget categories: Allocate your remaining money into categories:

- Essentials (food, transportation, etc.)

- Optional (entertainment, eating out)

- Culture/education (books, courses)

- Unexpected expenses (emergencies, repairs)

Step 2: Ask Yourself the Four Kakeibo Questions

Before spending money, reflect on these key questions:

- How much money do I have available?

- How much do I want to save?

- How much am I spending?

- How can I improve next month?

These questions help you shift from impulsive behavior to thoughtful decision-making.

Step 3: Track Your Expenses Daily

At the end of each day, record your expenses in your journal. Categorize them according to your budget, and note why you made the purchase. Were you stressed, bored, celebrating, or responding to a need?

This process helps you detect emotional triggers and reduce unnecessary expenses over time.

Step 4: Weekly and Monthly Reviews

At the end of each week, summarize your spending and reflect:

- Did you stay within budget?

- Were there any impulse purchases?

- What triggered overspending?

At the end of the month, calculate:

- Total income

- Total expenses per category

- Total saved

- Areas for improvement next month

Use these insights to adjust your budget and goals for the next cycle.

Step 5: Celebrate Progress and Keep Going

Celebrate even small wins. Saved $20 more than last month? That’s progress. Skipped one night of takeout? That’s a victory. The idea is to reinforce good habits, not chase perfection.

Practical Examples of Kakeibo in Action

Let’s say you earn $2,000 a month. You set a savings goal of $300. After deducting fixed expenses of $1,200, you allocate the remaining $500 across your spending categories:

- Essentials: $250

- Optional: $100

- Culture/Education: $50

- Unexpected: $100

Throughout the month, you log each purchase and review it weekly. You realize you’re spending too much on delivery food. In the next month, you reduce your optional budget to $80 and shift $20 toward savings.

With these small adjustments, you gradually build more control and confidence in managing your finances.

Benefits of the Kakeibo Method

- Greater awareness of your spending habits

- Improved self-control and reduced impulse spending

- Consistent and achievable savings goals

- Enhanced emotional relationship with money

- Less financial stress and more clarity

Many users of Kakeibo report feeling more in control of their lives — not just their budgets.

Tips to Maintain the Habit

- Set a reminder to write daily (5–10 minutes is enough).

- Involve your partner or family in the process.

- Use stickers, colors, or visual aids to make the journal more engaging.

- Be honest with yourself — no judgment.

- Don’t give up if you overspend; reflect and reset next month.

Final Thoughts: Saving Money Starts With Awareness

Financial well-being isn’t just about how much you earn — it’s about how mindfully you manage it. The Kakeibo method gives you the tools to be intentional, self-aware, and proactive with your money.

By slowing down and reflecting on your spending choices, you gain clarity, reduce financial anxiety, and create habits that support long-term savings and peace of mind.

Ready to transform your finances? Grab a notebook, set your goal, and start your Kakeibo journey today. Your future self will thank you.